Thursday, June 30, 2005

Tuesday, June 28, 2005

Yahoo Finance Stock Screener

Yahoo has a decent stock screener so try it out. They offer multiple searches on a variety of scans.

Yahoo Finance Stock Screener

Yahoo Finance Stock Screener

Monday, June 27, 2005

8 Simple Sell Rules

- Sell when a stock falls 7% to 8% from the purchase price

- Sell when the stock makes new price highs on low volume

- Sell when the Relative Price Strength Rating falls below 70

- Sell when the stock goes up too high, too fast

- Sell when the stock's 200 dma trends lower

- Sell when the industry leaders start struggling

- Sell when "distribution" hits major market indexes

- Sell when earnings growth slows down

Saturday, June 25, 2005

OVERBOUGHT/OVERSOLD OVERLOAD

Analysts love to show off by proclaiming that the markets have become overbought or oversold. Unfortunately, few of us seem to understand what these terms really mean or what we should do when these moments of truth arise.

OVERBOUGHT/OVERSOLD OVERLOAD

OVERBOUGHT/OVERSOLD OVERLOAD

Wednesday, June 22, 2005

Lessons Learned

Jack Rothstein talks about lessons learned in the market. I have been involved in this work for over 20 years now and still make mistakes and do my best to learn from them.

Lessons Learned with Jack Rothstein

Lessons Learned with Jack Rothstein

John Murphy's Ten Laws of Technical Trading

- Map the Trends

- Spot the Trend and Go With It

- Find the Low and High of It

- Know How Far to Backtrack

- Draw the Line

- Follow that Average

- Learn the Turns

- Know the Warning Signs

- Trend or Not a Trend

- Know the Confirming Signs

10 Laws of Technical Trading

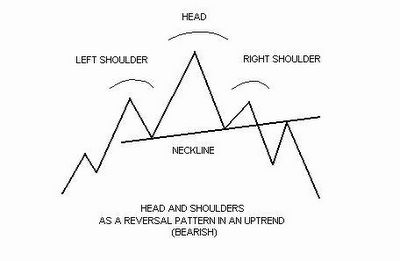

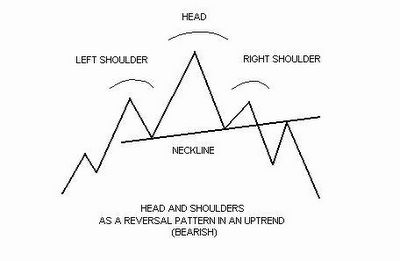

The Head and Shoulders Pattern

The head and shoulders pattern is generally regarded as a reversal pattern and it is most often seen in uptrends. It is also most reliable when found in an uptrend as well. Eventually, the market begins to slow down and the forces of supply and demand are generally considered in balance. Sellers come in at the highs (left shoulder) and the downside is probed (beginning neckline.) Buyers soon return to the market and ultimately push through to new highs (head.) However, the new highs are quickly turned back and the downside is tested again (continuing neckline.) Tentative buying re-emerges and the market rallies once more, but fails to take out the previous high. (This last top is considered the right shoulder.) Buying dries up and the market tests the downside yet again. Your trendline for this pattern should be drawn from the beginning neckline to the continuing neckline. (Volume has a greater importance in the head and shoulders pattern in comparison to other patterns. Volume generally follows the price higher on the left shoulder. However, the head is formed on diminished volume indicating the buyers aren't as aggressive as they once were. And on the last rallying attempt-the left shoulder-volume is even lighter than on the head, signaling that the buyers may have exhausted themselves.) New selling comes in and previous buyers get out. The pattern is complete when the market breaks the neckline.

Monday, June 20, 2005

Saturday, June 18, 2005

Dan Zanger's 10 Golden Rules

Dan Zanger a well respected trader in the business offers his 10 golden rules to trading.

Dan Zanger's Ten Golden Rules

Dan Zanger's Ten Golden Rules

The Channel Pattern

Channel Patterns should generally be considered as a continuation patterns. They are indecision areas that are usually resolved in the direction of the trend. Research has shown that this is true far more often than not, of course, the trend lines run parallel in a rectangle. Supply and demand seems evenly balanced at the moment. Buyers and sellers also seem equally matched. The same 'highs' are constantly tested, as are the same 'lows'. The stock vacillates between two clearly set parameters.

While volume doesn't seem to suffer like it does in other patterns, there usually is a lessening of activity within the pattern. But like the others, volume should noticeably increase on the breakout.

Channel Patterns should generally be considered as a continuation patterns. They are indecision areas that are usually resolved in the direction of the trend. Research has shown that this is true far more often than not, of course, the trend lines run parallel in a rectangle. Supply and demand seems evenly balanced at the moment. Buyers and sellers also seem equally matched. The same 'highs' are constantly tested, as are the same 'lows'. The stock vacillates between two clearly set parameters.

While volume doesn't seem to suffer like it does in other patterns, there usually is a lessening of activity within the pattern. But like the others, volume should noticeably increase on the breakout.

Thursday, June 16, 2005

The Flat Base Pattern

The Flat Base Pattern

The Flat Base is a stock pattern that goes horizontal for any length of time. Very powerful advances can be had from this formation. What we look for is volume drying up as the stock stays at or about the same level going horizontally.

Draw a trend line across the top of this formation. As the stock proceeds through the trend line, the stock is bought as it breaks the trend line and volume increases.

The Flat Base is a stock pattern that goes horizontal for any length of time. Very powerful advances can be had from this formation. What we look for is volume drying up as the stock stays at or about the same level going horizontally.

Draw a trend line across the top of this formation. As the stock proceeds through the trend line, the stock is bought as it breaks the trend line and volume increases.

Wednesday, June 15, 2005

Monday, June 13, 2005

The Parabolic Curve is probably one of the most highly prized and sought after pattern. This pattern can yield you the biggest and quickest return in the shortest possible time. Generally you will find a few of these patterns at or near the end of a major market advance. The pattern is the end result of multiple base formation breaks.